Unemployment in the Great Depression

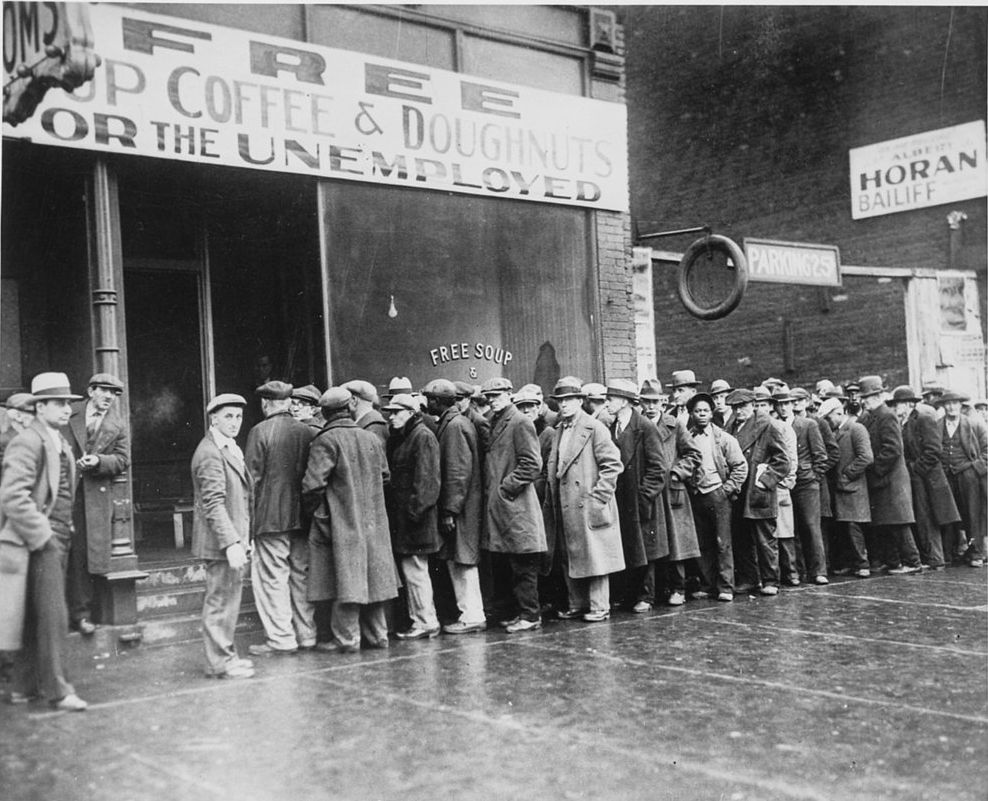

The Great Depression was the worst economic period in history. In the United States, unemployment rose to 25% at its highest level during the Great Depression. Literally, a quarter of the country's workforce was jobless.

This number translated to 15 million unemployed Americans in 1933. As the Depression spread across the globe, some countries saw unemployment as high as 33%.

There are several reasons why unemployment rose so high during this period.

First, people who had money invested in the stock market lost much of their savings during the Wall Street Crash of 1929. This caused them to spend less, which created lower demand for goods and services.

With businesses seeing a fall in spending, they cut back on output and employed fewer workers. This was particularly noticeable for luxury goods like motor cars.

The next major reason for unemployment also began with the stock market crash. When shares fell, many investors and ordinary people lost significant sums and went bankrupt.

Banks started to see loan defaults where people could not afford to pay their mortgages. There were concerns banks were running out of money. This led to well-publicized "bank runs" where lines of people sought to withdraw their savings before their bank closed. Many banks went bankrupt leading to people losing their entire savings. This led to a fall in the money supply and deflation (falling prices).

Another major reason for unemployment came from an agricultural recession. Less demand for goods led to lower prices and farming often became uneconomical. Dust storms in the Midwest also devastated farms. Many jobs were lost in rural areas, leading to a large migrant workforce seeking employment in new places, especially California.

The next reason for unemployment was a trade war. In response to worsening economies, countries began raising tariffs to protect their own industries. In 1930, the US passed the Hawley-Smoot Tariff, which placed tariffs on 20,000 imported goods. However, this led to retaliation as other countries placed tariffs on American exports. This led to a further decline in trade and new job losses, worsening the Depression worldwide.

Finally, poor government policies worsened unemployment. In 1930, the US Federal Reserve temporarily raised interest rates to try and protect the value of the dollar and the gold standard.

This was a counter-intuitive policy, but highlights a problem of the gold standard and trying to protect value of the currency – rather than provide monetary stimulus. If the government had instead lowered interest rates, it would have encouraged spending and helped promote the economy.